Top Workday Training Institutes in Bengaluru near me

Workday Benefits Course in Bengaluru

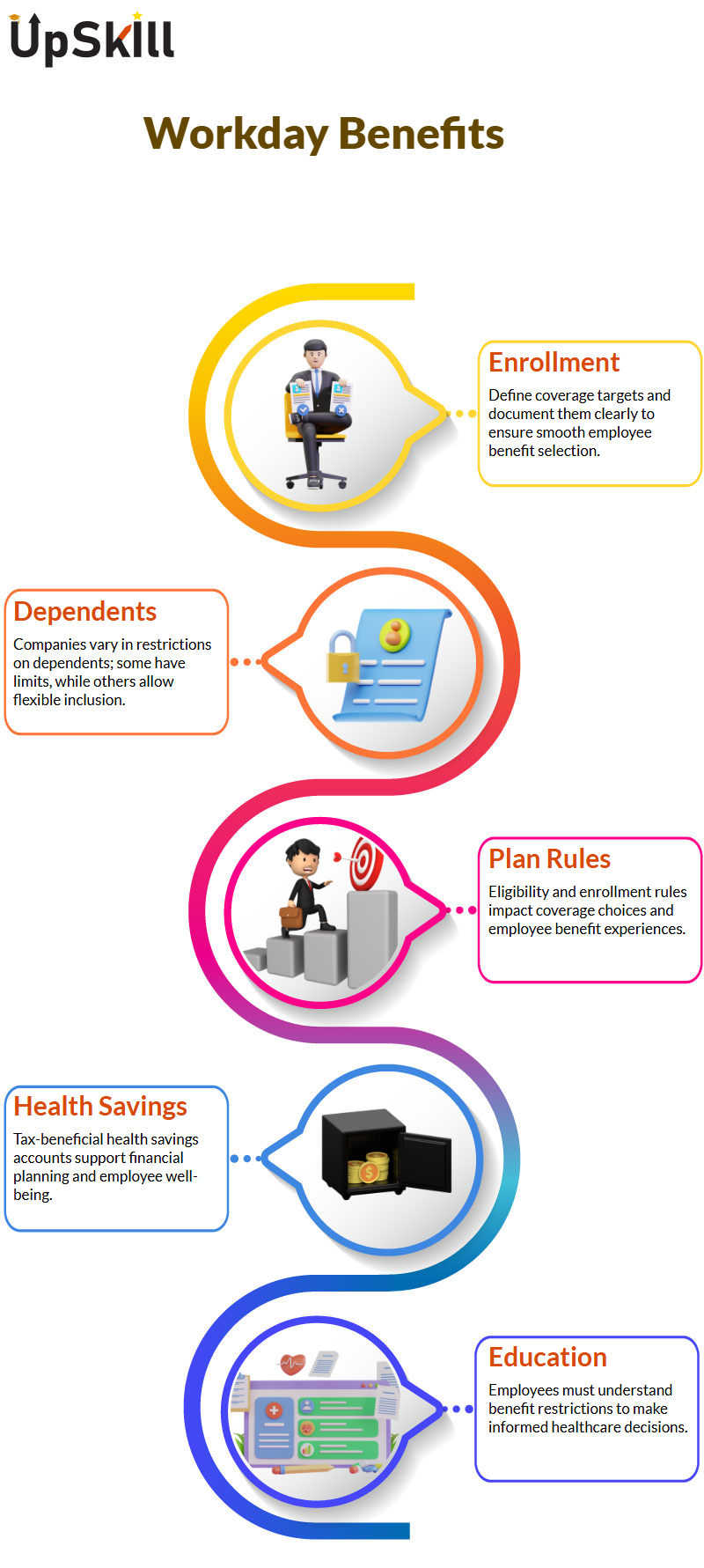

Navigating Workday Benefits Enrollment

Navigating Workday benefits enrollment can be confusing and time-consuming, yet choosing healthcare coverage that provides your employees with maximum support should always be prioritised over any other priority.

Our experts are on hand to make this easier – choose wisely so they receive maximum assistance.

As part of setting up healthcare coverage types, all required targets for coverage must be clearly defined and documented.

Certain companies limit the number of dependents allowed, while others have no restrictions.

An employee can register their spouse and two dependent children under the policy, if applicable.

Plan specifications vary across companies, a point often explored in the Workday Benefits Course in Bengaluru.

In some, dependents must be included, while in others, it’s up to employees themselves to decide.

Being aware of this variation allows individuals to make more informed choices regarding healthcare benefits.

Educating Employees on Workday Benefit Restrictions

Workday Benefits’ core is comprised of payroll, health savings accounts (HSA), retirement savings plans and other employee-oriented benefits such as retirement.

Employees are allowed to save for health expenses using tax benefits, and properly managed health savings accounts can have a profoundly positive impact on employees’ financial planning.

Relatives of employees also play a role in determining merit eligibility, aside from receiving their usual employee benefits automatically, spouses and children are subject to specific operating rules that govern their participation in the benefits.

Establishing eligibility rules is vital in creating an efficient enrollment experience with minimal issues and complications, a principle emphasised in the Workday Benefits Course in Bengaluru.

Broad Plan Rules enable the precise implementation of policy within an in-house process, specifying who may or may not be covered as dependents and limiting the number of dependents that can be covered.

Employees are educated on these restrictions to help select plans best tailored to their needs.

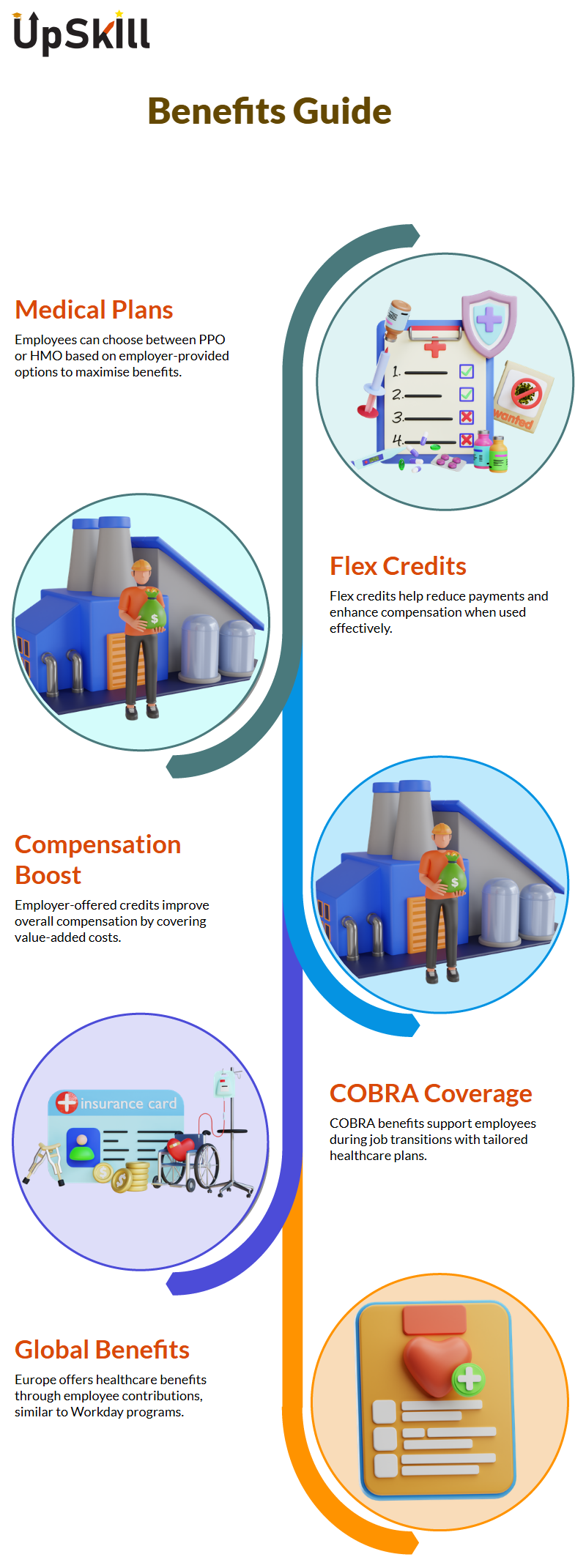

Maximising Workday Benefits Through Informed Choices

To maximise benefits received, one must gain an understanding of how Workday Benefits’ medical benefits system operates.

Employees enrolled in various health coverage plans, such as PPO or HMO, should be aware that they have options when selecting a plan based on what their employer provides.

This way, they maximise what they get back.

Understanding how to use flex credits effectively is a focus of the Workday Benefits Course in Bengaluru, as they help employees minimise payments and maximise compensation.

Companies sometimes offer employees credits that can be applied toward value-added costs.

By earning these credits, employees have the opportunity to reduce their payments while improving their overall compensation packages.

COBRA Workday Benefits During Life Transitions

Situations, such as job loss and unexpected life events, often prompt employers to offer COBRA benefits to employees in these instances.

COBRA coverage provides access to necessary healthcare coverage during job transitions, tailoring each benefit program amendment to the specific circumstances of both the company and the user.

Eligibility for specialised healthcare plans and programs based on individual circumstances is one of the topics discussed in the Workday Benefits Course in Bengaluru, especially for employees from diverse backgrounds.

Similar benefits exist in Europe, where healthcare benefits for employees are funded through employee contributions to income.

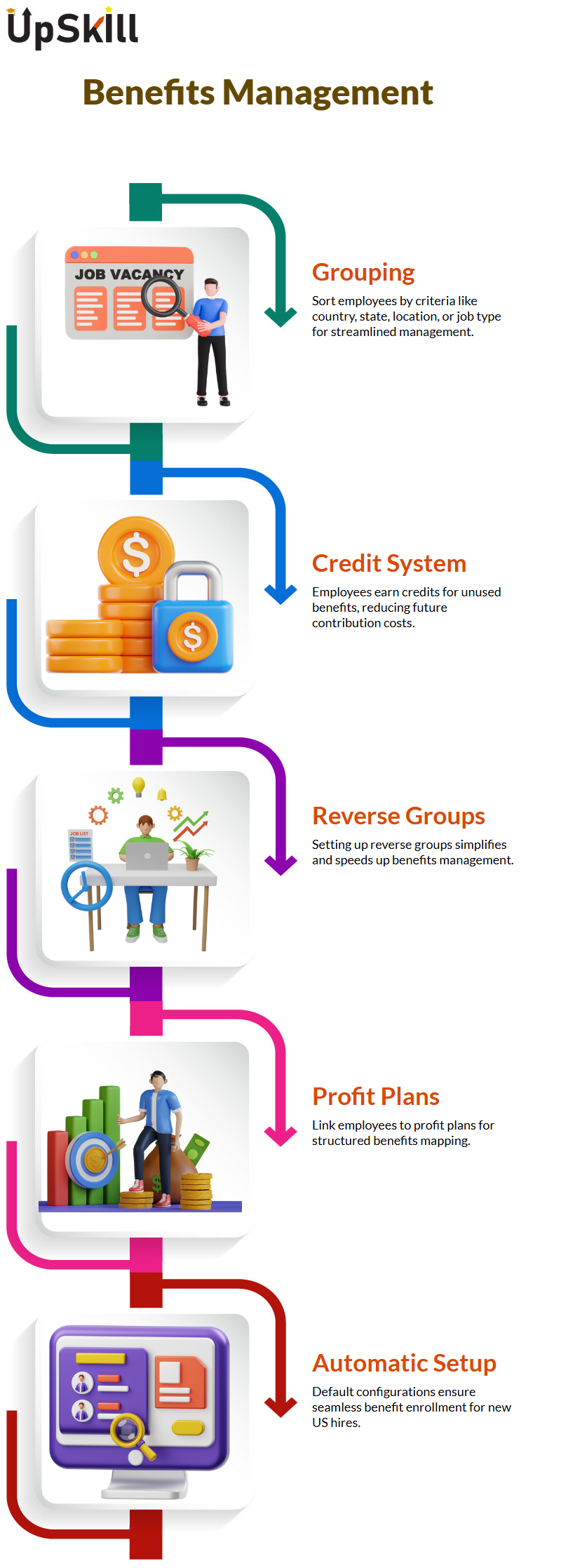

Comprehension Workday Benefits

Workday Benefits requires us to have an in-depth knowledge of its procedures and impact.

Grouping enables users to sort employees by various criteria, including country, state, location, or job type.

It eliminates the chaos commonly associated with poorly managed Workday Benefit distributions, particularly when determining plans for U.S. staff, as discussed in the Workday Benefits Course in Bengaluru.

Setting up a reverse group makes the process easy and fast.

Likewise, forming profit groups makes managing finances much less cumbersome than before.

To achieve this goal, the primary requirements include those related to state policies, for instance, selecting employees within the US.

How the Workday Benefits Credit System Works

Do you understand the concept of Workday Benefits’ perk credits?

Think about it this way: when insuring your car, if you drive safely but haven’t yet qualified for an insurance discount, the insurer would offer discounts as a reward for safe driving behaviour.

In Workday Benefits’ perk credits concept is similar in this way – imagine similarly insuring yourself: when driving safely without filing claims yet, and never claiming discounts yet, they reward you by giving discounts as well.

According to insights shared in the Workday Benefits Course in Bengaluru, when employees don’t make benefit claims during the year, they may earn credits that ease future contribution costs.

Mapping Workday Benefits Plans

Aligning benefits plans is also central to Workday Benefits management.

In Workday, this involves creating a group with specific profit plans linked to it, allowing for continued mapping of profits to employees.

Employees should receive the comprehensive benefits package to which they are eligible.

Workday Benefits can start automatically, which is why the Workday Benefits Course in Bengaluru emphasises the importance of a reliable default configuration for optimal performance.

As an illustration, all new US hires automatically qualify for default benefit plans, such as 401 (k), flexible spending accounts, or health savings accounts.

Workday Benefits’ automatic setups enable quick service provision and progress toward improved efficacy.

Open Enrollment in Workday Benefits

Workday Benefits open enrollment is designed to engage employees directly.

Employees will have an engaging experience selecting and editing benefits at their leisure for an enhanced workplace experience.

There is usually only a limited window during which employees can enrol for Workday Benefits in preparation for the following year.

Delaying employee onboarding dates (EOC) results in waiting until enrollment cycle two takes place to enrol for Workday benefits.

The Workday Benefits Course in Bengaluru highlights how Workday Benefits combines plan, group, and employee data to generate the final profit selection for employees.

Employees will have the power to modify and confirm their own Workday Benefits at specific intervals as part of an employee experience management system.

Incident Types and Workday Benefits Rules

Workday Benefits allows employees to enrol or unenroll from benefits using enrollment activity types, conditions, and reasons why the benefit was added or removed.

For instance, once an employee is hired into an organisation, they’ll automatically become enrolled without needing to take any steps themselves.

Once an employee no longer works at that location, their benefits will become null and void.

At the same time, life events such as marriage or the adoption of children necessitate changes to Workday Benefits to accommodate new dependents.

Workday Benefits establishes enrollment rules driven by claims and duration choices, allowing employers to control deduction start dates and coverage alignment, a topic covered in the Workday Benefits Course in Bengaluru.

The Open Enrollment Window in Workday Benefits

By design, Workday Benefits open enrollment windows are typically set from February 1 to March 1 each year.

During this period, staff must select their Workday Benefits plan for the upcoming year.

Employees absent during the Workday Benefits window may need manual corrections or must wait until the next enrollment cycle, a process detailed in the Workday Benefits Course in Bengaluru.

Accordingly, staff should submit their choices simultaneously so they have sufficient help from coworkers in case any developments arise outside their timelines.